Audiences

Trends

Industry

Emerging luxury brands reshaping the global market

The Luxury Market in 2026

The defining characteristic of the luxury market in 2026 is not decline, but discipline. According to The State of Fashion 2026, global luxury growth has stabilised at 2–4%, a marked shift from the post‑pandemic rebound years, with performance increasingly concentrated among the strongest brands.

Crucially, the report finds that over 80% of value growth in 2026 is generated by the top 20% of brands, signalling a widening gap between culturally relevant leaders and the remainder of the market. This concentration effect has profound implications: luxury success is no longer distributed evenly across categories, geographies or brand tiers.

At the same time, luxury consumers are buying less frequently. More than 60% of global luxury consumers now actively assess price increases against perceived quality, brand behaviour and experience, up from under 40% prior to 2023. This shift reflects a consumer base that is not disengaging from luxury, but interrogating it more rigorously.

In this context, emerging luxury brands are not those chasing visibility or scale, but those designed to withstand scrutiny.

Redefining “emerging luxury” in 2026

Historically, emerging luxury was associated with rapid growth, trend responsiveness and cultural novelty. In 2026, these characteristics are insufficient — and in some cases counterproductive.

An emerging luxury brand today is defined by:

- clarity of value proposition

- emotional specificity rather than broad aspiration

- marketing systems capable of sustaining loyalty

- disciplined expansion and controlled distribution

Importantly, many brands reshaping the market are not new. They are re‑emerging through repositioning, renewed cultural relevance or superior brand management. Emerging luxury in 2026 is therefore a structural designation, not a temporal one.

From status signalling to emotional utility

One of the most significant shifts shaping luxury in 2026 is the movement away from overt status signalling towards emotional utility. Luxury is increasingly expected to deliver calm, reassurance and personal meaning in an environment characterised by economic uncertainty and cultural fatigue.

Business of Fashion identifies wellbeing and experience‑led luxury as among the fastest‑growing value drivers in the sector, with experience‑centric categories growing at nearly twice the rate of product‑only categories in 2026.

This is reinforced by WGSN’s Future Consumer research, which shows that 73% of affluent consumers now associate luxury primarily with emotional balance and mental wellbeing, rather than prestige alone. As a result, luxury brands are being evaluated not just on what they sell, but on how they make consumers feel over time.

This shift fundamentally alters the mechanics of desirability.

Marketing as luxury infrastructure

In 2026, marketing is no longer a support function in luxury. It is a core system of value creation.

The BoF Insights Brand Pulse Index an AI‑driven performance framework measuring Discoverability, Identity, Value, Connection and Love, demonstrates that brands excelling in Connection and Value generate up to three times higher advocacy signals than those leading on discoverability alone.

More significantly, the Index identifies emotional connection as the strongest predictor of brand resilience during periods of demand softening, outweighing price competitiveness and campaign spend. This reframes marketing from amplification to infrastructure: a mechanism that converts relevance into loyalty.

For emerging luxury brands, the implication is clear. Visibility without emotional attachment is fragile.

Loyalty in 2026: what actually works

Across categories, brands maintaining loyalty in 2026 share consistent characteristics:

- Value clarity: Consumers understand pricing mechanics and reward brands that justify cost through quality and experience.

- Emotional consistency: Shifting aesthetics without shifting values preserves trust.

- Experience ecosystems: Private access, service and cultural engagement outperform transactional loyalty schemes.

- Invisible technology: AI supports personalisation and discovery without overwhelming the consumer.

These mechanisms reflect a broader truth: loyalty is emotionally earned, not mechanically engineered.

Brand profiles: who is reshaping the global market

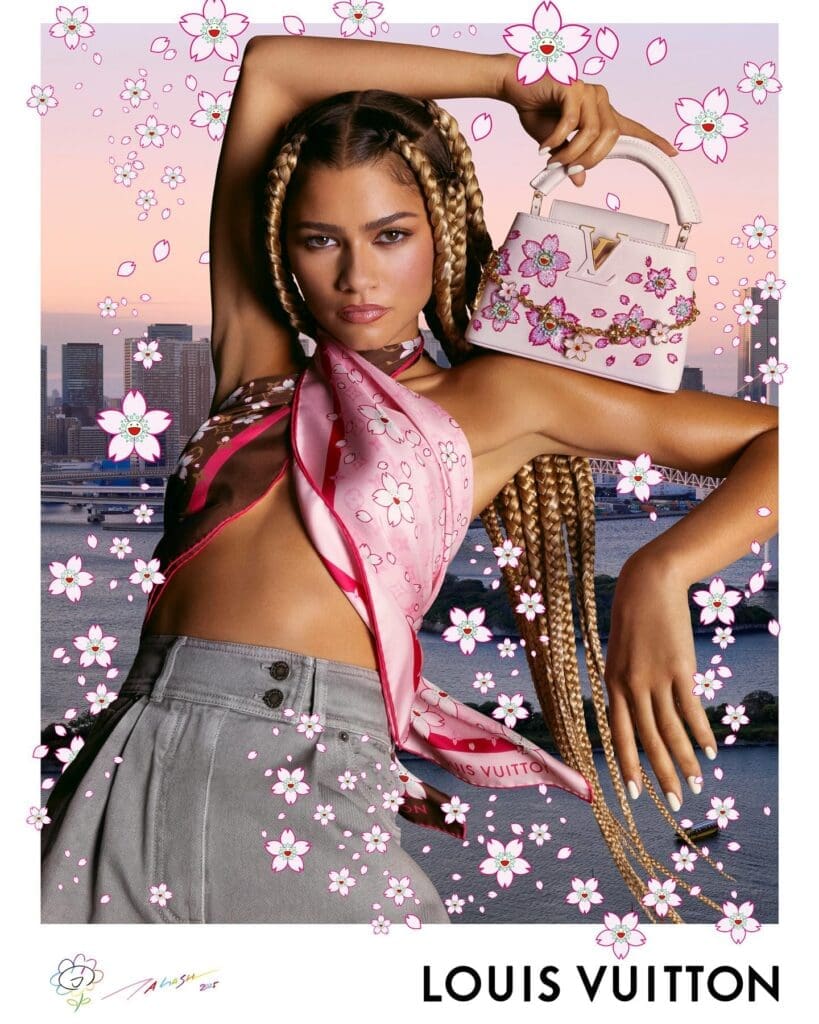

Louis Vuitton: industrialised emotional loyalty

Louis Vuitton continues to rank in the top tier of the Brand Pulse Index, performing strongly across Discoverability, Connection and Love. Its leadership demonstrates that scale and emotional relevance are not mutually exclusive when brand systems are coherent.

Marketing-wise, Louis Vuitton excels in translating global visibility into sustained emotional engagement. Cultural collaborations reinforce, rather than dilute, brand identity, while immersive retail environments convert transactions into memory. The brand also shows above‑average repeat engagement signals, underlining its ability to turn awareness into loyalty rather than one‑off demand.

Louis Vuitton’s performance illustrates that emotional loyalty can be industrialised without becoming impersonal.

Chanel: emotional capital as competitive advantage

Chanel leads the Brand Pulse Index on Brand Love in 2026, holding the highest emotional attachment score among luxury fashion houses. This position is not driven by campaign frequency, but by narrative coherence across decades.

Chanel’s marketing strength lies in its ability to maintain continuity while remaining culturally present. Beauty and fragrance act as accessible entry points that reinforce aspiration, while couture and fashion preserve symbolic authority. The result is intergenerational loyalty built on trust rather than trend alignment.

Chanel demonstrates that emotional capital once accumulated becomes a formidable competitive moat.

Jacquemus: cultural precision and digital-era loyalty

Jacquemus is one of the clearest examples of how a contemporary brand can evolve from cult relevance to structural significance without losing its edge. Built natively in the social era, the brand transformed early Instagram mastery into a coherent ecosystem that fuses digital theatre, destination runway spectacles and tightly controlled distribution.

Its viral shows staged in landscapes from wheat fields to salt flats function as strategic memory devices, generating global cultural recall rather than fleeting hype. Strong performance across discoverability and connection metrics reflects its ability to convert visibility into sustained engagement, reinforced by founder presence and narrative intimacy.

Selective expansion into accessories and experiential retail underscores a disciplined growth model: scale must strengthen equity, not dilute it. In 2026, Jacquemus proves that emerging luxury is defined by narrative coherence, digital fluency and the capacity to sustain emotional loyalty at scale.

Burberry: heritage recalibrated for renewed desirability

Burberry’s 2025–2026 performance illustrates how a heritage house can restore relevance through disciplined repositioning and strategic brand clarity. After several challenging years, the brand reported a 3 % year-on-year increase in comparable store sales in the 13-week holiday trading period ending December 2025, with retail revenue rising to £665 million. Growth was particularly evident in Asia Pacific, where Greater China rose 6 %, driven in part by stronger Gen Z engagement.

Demand signals reinforce this recovery. In the Lyst Index Q4 2025, Burberry climbed five places, with a 38 % increase in global consumer demand. Iconic heritage products such as the Nova Check scarf saw a 307 % surge in search demand, demonstrating that classic brand codes, when re-activated with precision, retain powerful cultural currency.

Strategically, Burberry has recalibrated its product architecture — re-centring trench coats, scarves and ready-to-wear while moderating over-reliance on ultra-premium positioning. Importantly, improved full-price sell-through and reduced markdown intensity suggest renewed consumer confidence in perceived value.

Implications for emerging luxury brands

The luxury brands reshaping the global market in 2026 are not those expanding fastest, but those operating with the greatest strategic precision. With over 60% of consumers actively evaluating value, and emotional connection proven to drive up to three times higher advocacy, success is increasingly determined by marketing systems that convert relevance into loyalty rather than visibility into noise.

As growth concentrates among a smaller cohort of high‑performing brands, the definition of emerging luxury has narrowed. It now describes brands structurally aligned with consumer expectations of trust, wellbeing and emotional return and operationally capable of sustaining that alignment over time.

In an era where AI governs discovery and cultural capital determines desirability, luxury’s future belongs to brands that combine craftsmanship with emotional intelligence and marketing discipline.